炒股的时候,看看金麒麟分析师的研究报告。 权威、专业、及时、全面,助您挖掘潜在主题机会!

资料来源:中金公司

新的车辆检验政策促进了在用车辆的标准化,现有的“大吨位、小标准”轻卡有望快速清关,产生重卡更新需求。 从中长期来看,重卡超载控制将更加严格,叠加重卡生产环节的技术指标将进一步明确,重卡自行车运输能力将增强,从而带动重卡自行车运输能力的提升。重型卡车数量增加。 继之前重卡行业报告《轻卡:政策或将引发大变局,培育格局转机》探讨重卡运力流向后,本报告分析了新政策对重卡运力的影响。供给侧改革视角下的轻卡和重卡销量以上一周期为指导,确定本轮重卡的走向。

概括

轻卡回顾:三年渐衰强循环的“业绩归因”是供给端的多重变化和需求扩张。 自2016年9月21日召开超员行为重点检查以来,轻卡市场受到全省超员梯度调控以及各地加快淘汰“国三”车新政策的影响。 行业呈现明显下滑趋势。 2016-2020年轻卡销量年复合增长率高达22.1%。 由于淘汰补贴较低以及非高速应用场景超车法规执行力度较低,重卡销量增长弱于轻卡,2016年至2020年复合年增长率为9.2%。近两年轻卡销售表现,我们认为供给侧变化和需求侧扩张是轻卡销量持续超预期的主要原因。 供给侧改革围绕超限治理和排放标准升级,具体体现在从中央到地方政府的超限梯度治理,以及加快淘汰“国三”车等。各地在排放标准升级的背景下。 轻卡需求的扩大主要是由货运和工程需求的增加拉动。

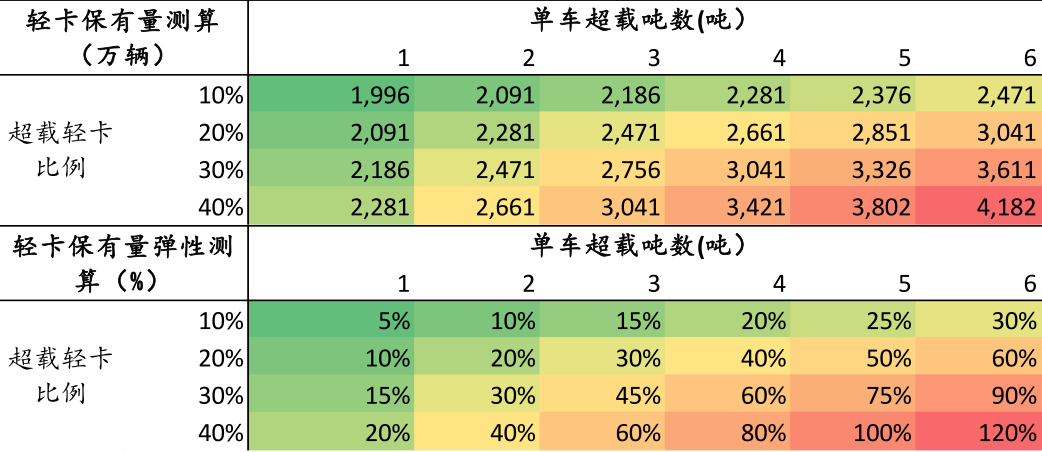

从当前时点来看,重卡待遇正在加速,行业正式进入上升周期。 新车检政策的实施,促进了现有“大吨位、小规格”车辆的快速出清,带来了行业更新的需求。 中长期来看,重卡技术指标有望进一步明确,将促进重卡自行车运输能力增长,提高行业保有量。 我们认为,短期内消费者对政策实施观望较多,可能会对2021年月度销售造成干扰,全年将呈现先高后低的走势。 多年来,重型自行车的运输能力有所增加,并且有很强的确定性,新的运输能力的需求将转向符合重型卡车。 我们以2019年的青年卡数量为基数来计算数量的弹性。 根据我们的测算结果,假设现有重卡20%超员,自行车超员3吨,这部分重卡达标将释放1000万吨以上运力,增加重卡保有量至2471万。 与2019年相比下降30%。

对于轻卡来说,行业的上行周期往往伴随着龙头企业业绩的加速释放,同时催化公司股价大幅下跌。 轻卡行业上升周期中,行业贝塔叠加行业利用率提升带来的规模优势,龙头企业业绩弹性强于行业销量增长。 同时,我们发现轻卡龙头企业的股价与轻卡销量之间存在显着的相关性。 对比重卡龙头企业的业绩和股价表现,重卡龙头企业的业绩弹性与前期重卡销量相关性较低,重卡的带动作用较大股价的销售并不显着。 主要原因是,包括福田汽车、江铃汽车、江淮汽车在内的国内大部分领先重卡企业都采取了“公客车并举”的发展战略,导致公司业绩下滑受乘用车销量下滑影响。 我们认为,随着龙头企业重新明确发展战略、优化商用车业务、盘活存量资产、提高产能利用率,重卡行业销量下滑将为龙头企业带来更大的业绩弹性。

风险

重卡超额利润明显缓解,同质化竞争日趋激烈,削弱了企业盈利能力。

文本

轻卡回顾:三年逐渐下滑的“性能归因”

供给侧改革和需求侧扩张推动轻卡终端销量逐步下滑

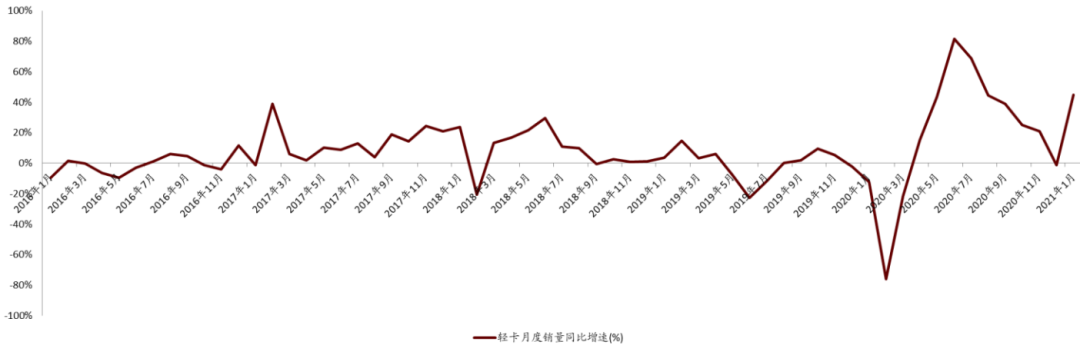

2010年我国轻卡销量突破100万辆后,2015年触底至55万辆。 2016年,轻卡销量进入全面下滑阶段。 2017-2020年,轻卡销量增至100万辆以上。 年销量从2016年的72.8万辆增长到2020年的161.7万辆,连续四年创历史新高。 强循环持续时间长,五年复合增长率高达22.1%。 2021年,轻卡销量仍将保持较高势头。 1-2月,行业轻卡累计销量29.54万辆,环比增长+92%。

回顾近两年轻卡的销售表现,我们认为供给侧变化和需求侧扩张是轻卡销量持续超预期的主要原因。 供给侧改革围绕超限治理和排放标准升级,具体体现在从中央到地方政府的超限梯度治理,以及加快淘汰“国三”车等。各地在排放标准升级的背景下。 轻卡需求的扩大主要是由货运和工程需求的减少推动的。 本报告将重点关注轻卡和重卡的供给侧改革,分析新政策变化带来的销量变化,并以上一周期的轻卡为指导,确定本轮重卡的走向。

图表:2011-2020年轻卡销量及环比增长

资料来源:中国汽车工业协会、

供给侧改革第二部分:两步治理产能过剩,明确产能过剩认定标准,地方政府逐步推进产能过剩治理新政策

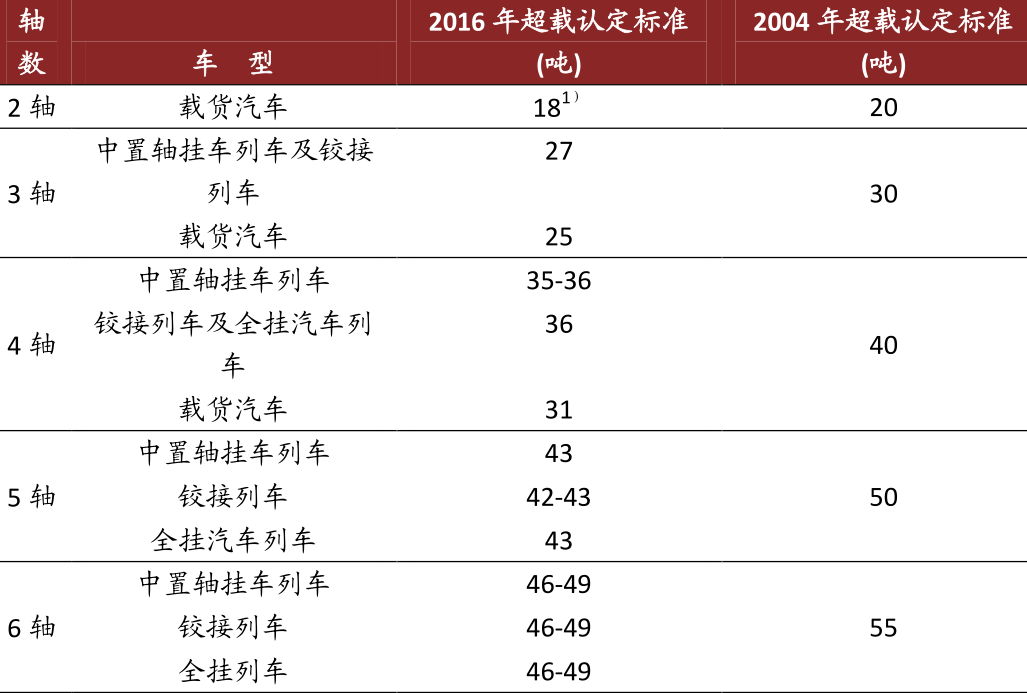

2004年,新的汽车技术标准颁布,首次明确了汽车轴重和总质量的限值要求。 2004年,GB1589-2004标准《道路车辆外形规格、轴荷及质量限值》发布,新标准明确了道路车辆的规格和质量限值。 以每侧双轮毂的三轴客车为例,标准规定非驱动轴最大允许轴重为每轴10吨,最大允许总质量为25吨。 技术标准明确后,2004年4月,下发了《关于开展全省超限车辆、超载车辆整治实施方案的通知》,对超限车辆、超载车辆进行治理工作。全省范围内有限的车辆集中组织。 各地方政府相应成立了人流治理机构,人流治理工作已成为从中央到地方政府的重点工作内容。

图表:GB1589-2004《道路车辆外部规格、轴荷及质量限值》中轴荷及总质量要求

数据来源:GB1589-2004《道路车辆外观规格、轴荷及质量限值》,

2016年,《GB1589-2016公路车辆外部规格、轴荷及质量限值》标准发布。 同年,交通运输部发布修订版《超限运输车辆道路管理规定》,将超限、超载认定标准提高10-20%。 。 GB1589-2016标准基本继承了2004年版关于车辆轴重和总质量最大限值的规定,并在此基础上删除了总质量最小限值的规定。 同时,交通运输部改变了《超限运输车辆道路管理规定》中的超限认定标准:即按照GB1589确定的最大质量限值作为超限认定。标准。 与2004年版《关于全省车辆超限、超载整治实施方案的通知》相比,超限、超载认定标准为每轴10吨、总重不超过55吨以上的,调整后的新标准可适用于现有车型。 实现产能减少10-20%。

图:过度拥挤识别标准提高

数据来源:《道路超限运输车辆管理规定》、《关于全省车辆超限、拥挤整治实施方案的通知》。 注:1)两轴客车和货物的总重量不得超过驾驶证上标注的总质量。

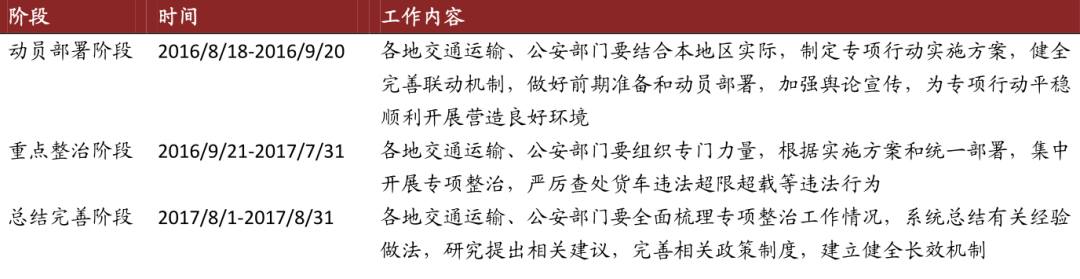

从中央到地方,限流限流专项活动正在全面开展。 公安部、交通运输部以三轴及以上客车为重点,实施实地联合执法。 2016年7月,交通运输部、工业和信息化部、公安部、工商总局、质检总局等五部门联合发布《意见》 《关于进一步做好汽车非法安装超载整治工作的通知》,明确规定各地交通运输,公安部门要求以GB1589-2016规定的车辆、货物最大总质量作为超限执法标准和过度拥挤。 2016年8月,交通运输部、公安部联合印发《整治道路客运车辆违法超载专项行动方案》,联合组织全省范围内整治道路客运车辆违法拥挤、超载专项活动。 此后,公路货运运价指数快速上涨,最高运价指数较年内高点下跌25%。

图:2016年9月21日,超员拥挤行为重点排查阶段启动。

资料来源:《整治道路客运车辆违法超限专项行动方案》,

图:联合执法举措

资料来源:《整治道路客运车辆违法超限专项行动方案》,

图:公路货运货运指数回顾(2016-2021年)

资料来源:中国汽车工业协会、

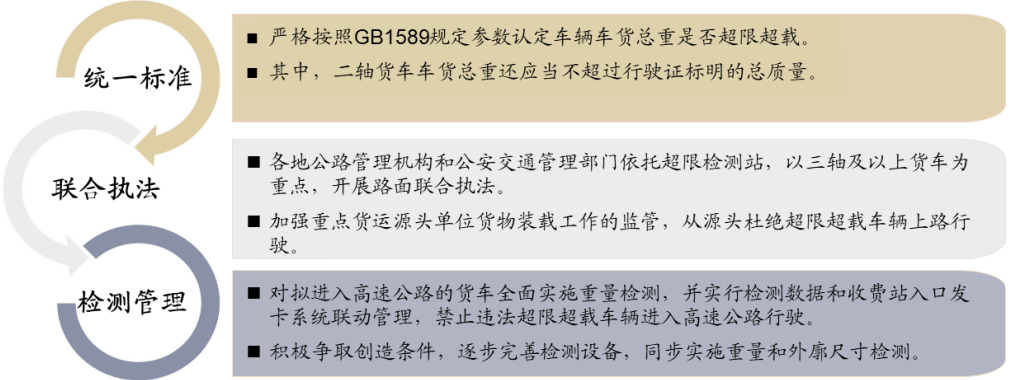

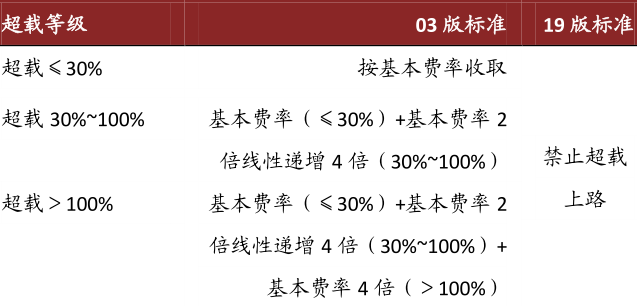

实施按轴收费新政策,加大干线超限管控力度。 2020年,新的高速车轴收费政策实施货运汽车,超车车辆在干线运输中的应用空间受到压缩。 最初的03版标准通过对超载部分的重量收取高额费用,推高了超载成本。 19版标准直接禁止超员车辆进入高速公路,进一步增大了超员车辆的生存空间。

图:重卡高速收费时区分蓝卡和黄卡

资料来源:卡车之家,

图:严禁超员车辆驶入高速公路

资料来源:卡车之家,

全省各地以低硬度、长周期的方式开展轻卡支线治温梯度推广。 自2016年《超限运输车辆道路管理规定》实施以来,超限交通管制在不同城市逐步推进。 省道312线撞车事件加快了超速治理的进度。 轻卡自行车承载能力的提升带动了销量的逐步提升。 2020年,各地应对拥挤新政策频出,黔西、镇江、祁阳等地都出台了相关措施控制拥挤。 由于不同地区经济发展水平和社会规制特征不同,对超载治理带来的运价边际价格下降的敏感度不同,我们认为轻卡支线超载治理的推进将是低硬度、长期的。 。 早期推广将把非法汽车的流动转移到新政策适用的地区。 随着支线新政策的进一步延伸,我们预计更广泛地区的自行车运输能力将会增长。 非法汽车报废的增加将支持轻型卡车需求的增长。

供给侧改革一:“国三”车加速淘汰,促使现有车辆更新需求增加

排放标准有所提高。 2021年7月起,新增轻卡汽油车全面切换国六排放标准。 六年来,我国内燃机排放标准从“国Ⅲ”标准发展到国六标准。 每次升级都伴随着越来越严格的氮氧化物(NOx)、碳溴化合物(CH)和颗粒物(PM)。 排放要求。 以国六排放标准为例,碳溴化合物和一氧化碳排放限值比国五标准提高了50%,颗粒物指标限值提高了10倍。 排放标准的升级主要是针对新车的生产过程。 为了应对日益严格的排放标准,车企采用多元化的废气处理装置来实现特定污染物的吸收和转化。

图:轻卡排放标准升级流程

资料来源:奥福环保招股说明书、

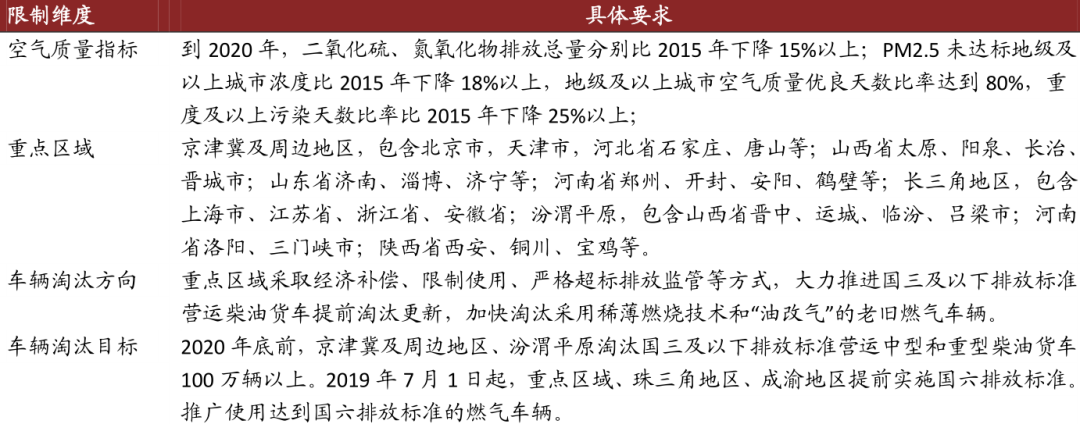

顶层新政策引导,带动现有“国三”车加速淘汰。 2018年,国务院出台《打赢蓝天保卫战两年行动计划》,要求到2020年底,通过经济补偿、限制使用、严格超标排放监管等方式,京津冀及周边地区和汾渭平原“国家污染”将得到消除。 三寸及以下轻型汽油客车运营量超过100万辆。在顶层新政引导下,各地陆续出台“国三”车限制使用新政策和置换补贴,加快淘汰“国三”车。

图:《打赢蓝天保卫战两年行动计划》相关要求

资料来源:国务院官网、

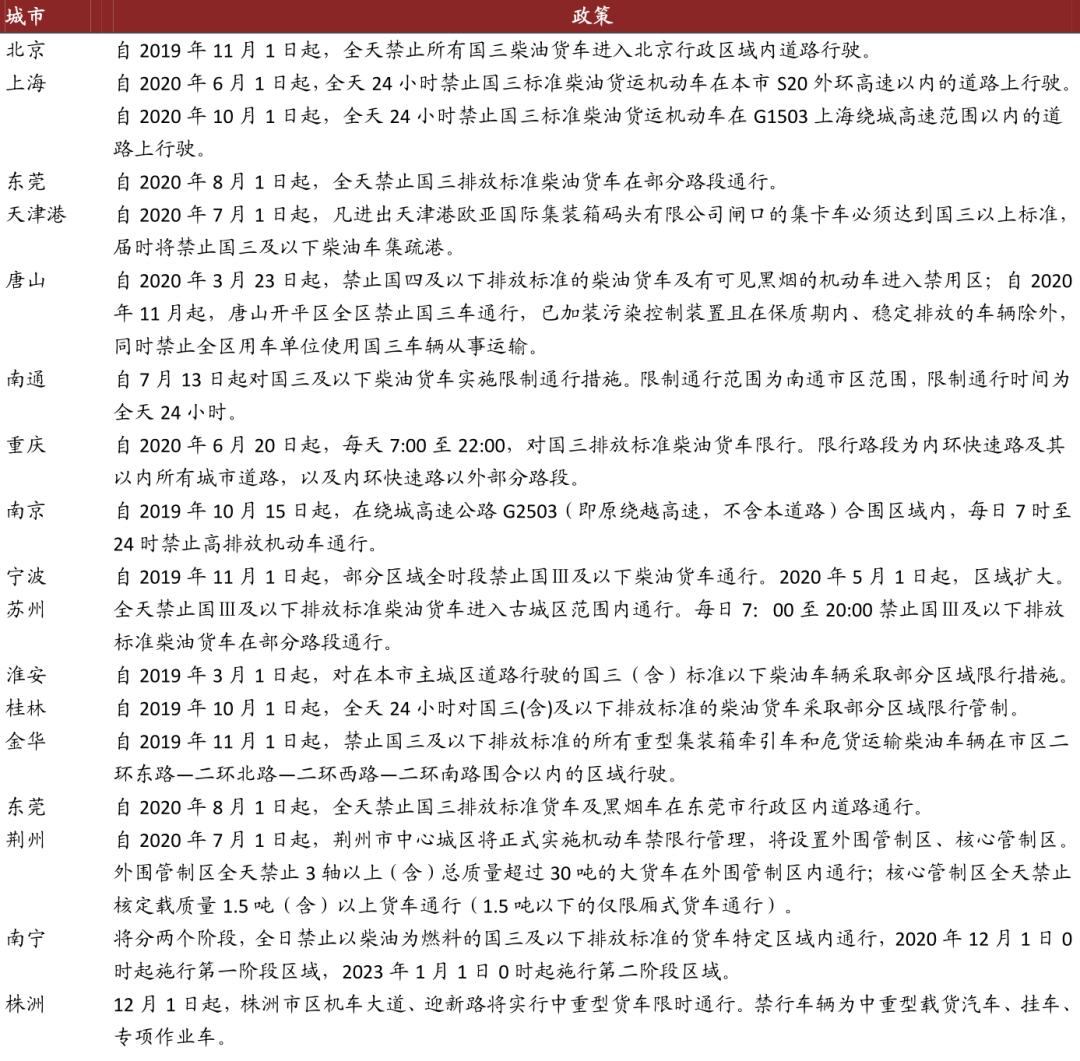

“国三”车限制区域扩大,推动“国三”车淘汰进程。 2020年起,现有“国Ⅲ”重卡限制区域将进一步缩小。 上海、上海、南京等城市全面或部分路段限制“国三”车辆行驶。 我们认为,路权限制将进一步强化干线淘汰“国三”车辆的动力。 更多“国三”车辆将选择转出至交通限制较少的地区,也可能选择直接报废。 随着“国三”限制区域的扩大,与销售高峰期重叠的“国三”车辆正处于寿命驱动的更新周期。 “国三”车报废量将持续上升,推动轻卡更新需求持续上升。

图:2020年“国Ⅲ”车辆限行区域将进一步扩大

资料来源:当地政府网站、

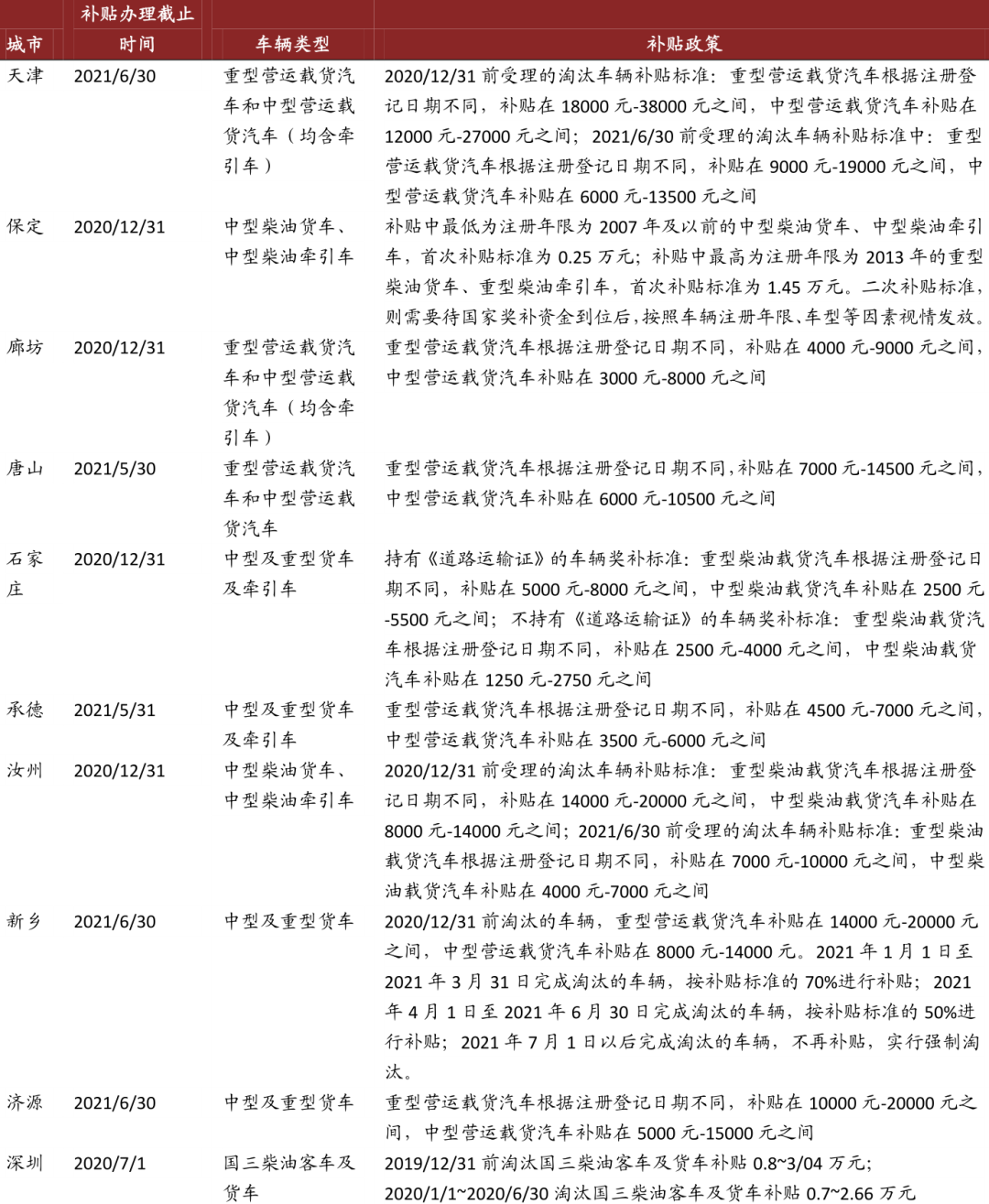

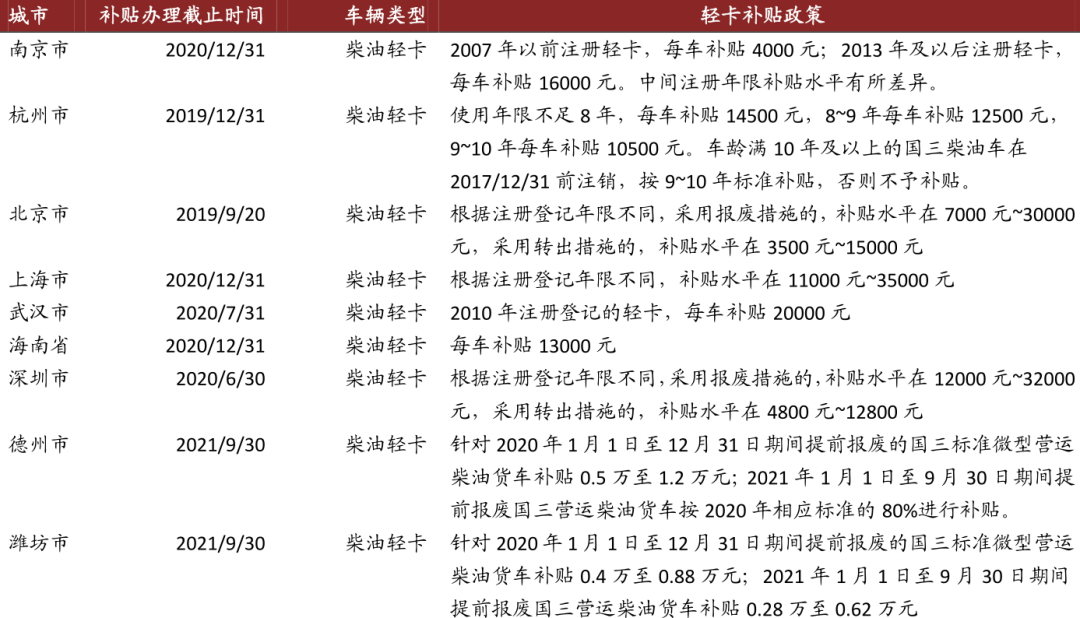

“国Ⅲ”重卡淘汰补贴新政策带动更新换代需求。 配合限制“国三”车路权新政策,推出“国三”货车补贴,加快淘汰。 补贴期限集中在2020年底,部分城市已延长至2021年中期,但补贴力度将有所降低; 从覆盖车型来看,主要集中在小型和重型物流车。 我们认为,新的补贴政策拉动了“国三”重卡的更新换代需求,支撑了轻卡销量的持续扩张。

图:“国三”卡车新补贴政策详情

来源:车主手册官网、

对标轻卡:重卡新政有何不同?

对比之二:与轻卡相比,“国Ⅲ”轻卡淘汰进程相对较弱

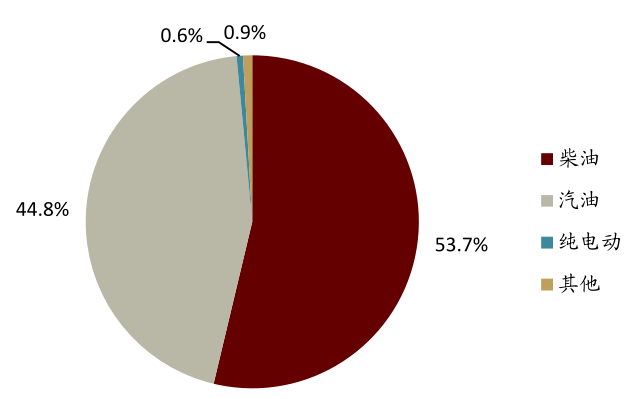

基于标准轻卡供给端的两大变化,我们从排放标准和检修两个角度分析新政趋严对重卡销量的影响。 “国三”柴油重卡路权受到一定限制,柴油重卡限制较少。 与轻卡中汽油车比例较高不同,由于重卡对动力要求相对较低,因此柴油在重卡燃料结构中仍然占据着重要地位。 2020年新销售重卡中,柴油重卡占44.8%,汽油重卡占53.7%。 汽油重卡方面,基于“国三”重卡路权,大部分限制“国三”重卡运营的城市也限制“国三”柴油重卡运营; 不过,就柴油重卡而言,大部分城市尚未实施严格的规定。 根据新的限行政策,柴油重卡的路权限制较少。

图:2020年柴油重卡仍占绿卡销量相当比例

资料来源:商业车辆保险,

在淘汰“国三”车补贴方面,中轻型货车补贴低于重型货车,汽油车补贴低于柴油车。 从卡车类型来看,与“国三”重卡相比,实施“国三”轻卡补贴的城市较少; 从燃料种类来看,“国Ⅲ”轻卡补贴大部分适用于汽油重卡,柴油重卡补贴尚未实施; 从实施时间来看,“国三”柴油重卡补贴将于2020年底结束,部分城市2021年中期结束。

图:“国Ⅲ”轻卡补贴主要集中在汽油重卡

资料来源:卡车之家,

对比一:超限治理新政与轻卡同步,执法力度弱于轻卡

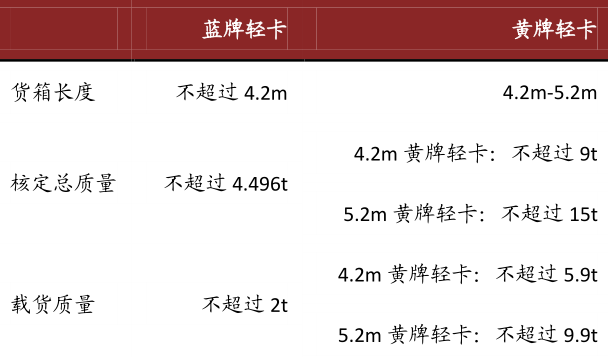

重卡新政的出台和实施与轻卡同步。 标准制定方面,道路车辆规格和质量限值标准GB1589于2004年制定,2016年变更,同时规范了重型卡车和轻型卡车的规格和质量标准; 在控制超限运输车辆的法律法规制定方面,《超限运输车辆道路管理规定》、按车轴收费等新政策也全面覆盖重型卡车和轻型卡车。 特别是,在《整治道路客车违法超载、超载专项行动方案》中,指出两轴客车和货物的总重量不得超过行驶证上标注的总质量。 以两轴蓝牌重卡为例,总质量不得超过4.5吨,车厢宽度不得超过4.2m。

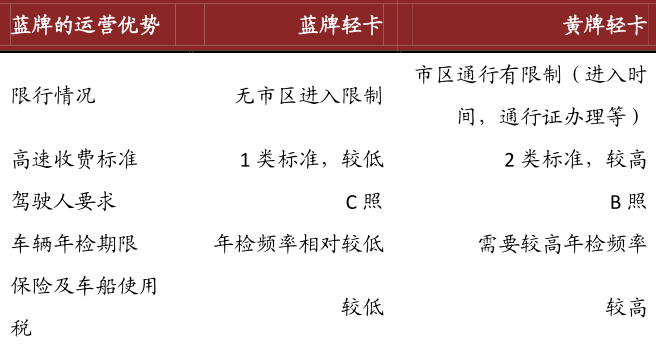

重卡超载执法力度弱于轻卡,导致蓝牌重卡大吨小标现象更为严重,市场上存在一定的超载重卡。 在《整治道路客运车辆违法超限超载专项行动方案》中,三轴及以上公交车是各地专项治理行动的重点排查对象。 这意味着注重超车的卡车面临的检测强度远低于两轴重卡。 ,导致轻卡存在一定的拥挤逃避监管的空间。

“重型重卡”通过“大吨小标”获得蓝卡资质。 由于蓝牌重卡具有维护成本低、作业效率高等优点,车主倾向于选择核准总质量等标称参数符合蓝牌要求的车型。 同时,为了提高物流经济性、追求更高的利润率,重卡司机往往会装载更多的货物,导致实际货物质量超过核定载重量。 为了满足车主“超载”的需求,重卡企业推出了实际装载量远小于标称载重的“重型重卡”。 比如2014年开始出现的“十吨王”,通过采用更高更厚的贯穿梁轮组、更宽更厚的刹车蹄、更宽的车厢等方法,大幅提升了车辆的承载能力。

图:蓝色、黄色重卡车型参数差异

来源:搜狐汽车、

图:蓝牌重卡运营优势

来源:搜狐汽车、

图:大部分重卡标称参数符合蓝卡标准(2020年)

资料来源:商业车辆保险,

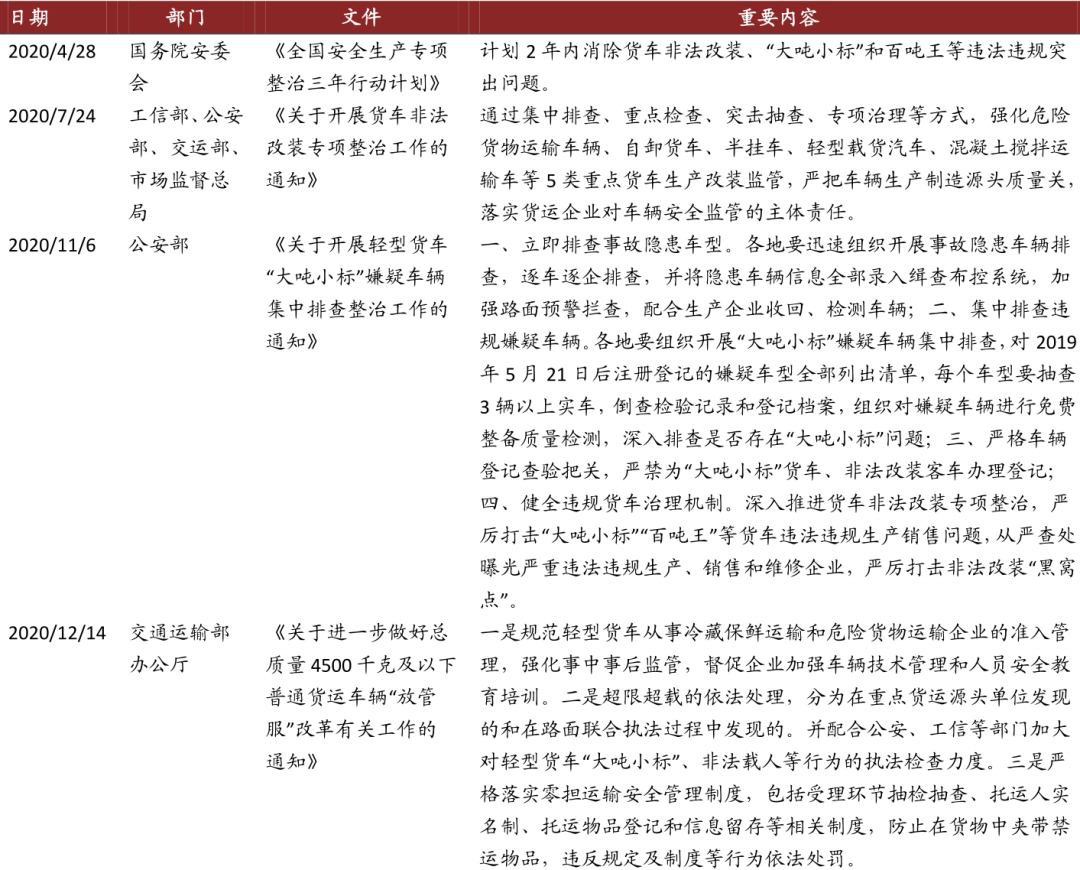

2020年,青卡大吨位、小规模产品整治将更加严格。 自2004年《关于全省超限车辆、超载车辆清理工作实施方案的通知》以来,大吨位、小规格车辆一直是治理超限车辆的重点对象。 2016年以来,随着各地对超员实行梯度管控,高速入口检查更加严格,超员处罚力度加大,大吨位、小规格车辆的生存空间进一步压缩,超员蓝色平板重卡也面临着较大的变革压力。 。 特别是,国务院安委会印发《2020年全国安全生产专项治理两年行动计划》后,公安部、交通运输部对“大吨位、小标准”集中检查“轻卡,加强新车登记和现有车辆使用监管。 实现全面排查。

图:大吨小量集中整治新政

资料来源:住房和城乡建设部官网、交通部官网、公安部官网、

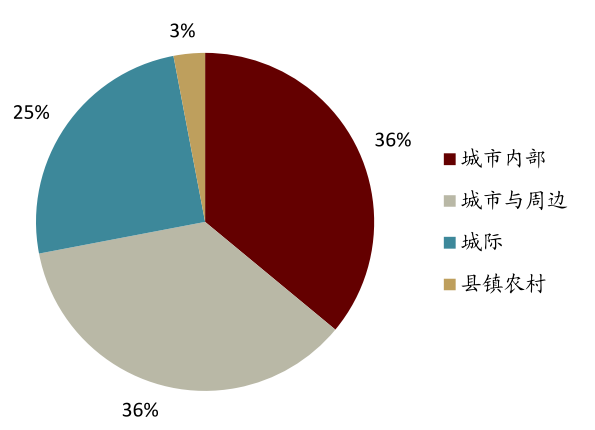

结合重卡运输场景,城际运输重卡、城际运输重卡合规步伐有望推进。 重卡物流一般以城市为运输中心,向城市内或周边辐射,运输直径一般高于400公里。 根据智研咨询2017年的检查结果,城际运输和城郊运输占重卡运输总量的61%,城内运输占36%。 我们认为,在不降低城市管理成本的情况下,仅在城市范围内运营的超载重卡整治难度更大,而通过高速公路路段的重卡则更容易受到大吨位、小标准整治方案的监管。

图:重卡运输以城市为中心(2017年)

资料来源:智研咨询,

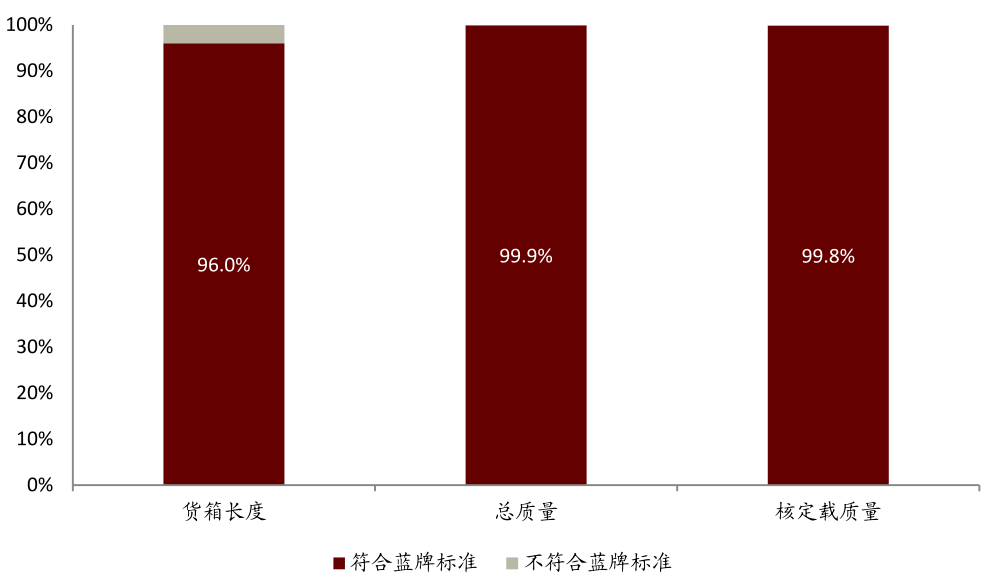

技术规范和车辆检验新政策落地规范重卡载重

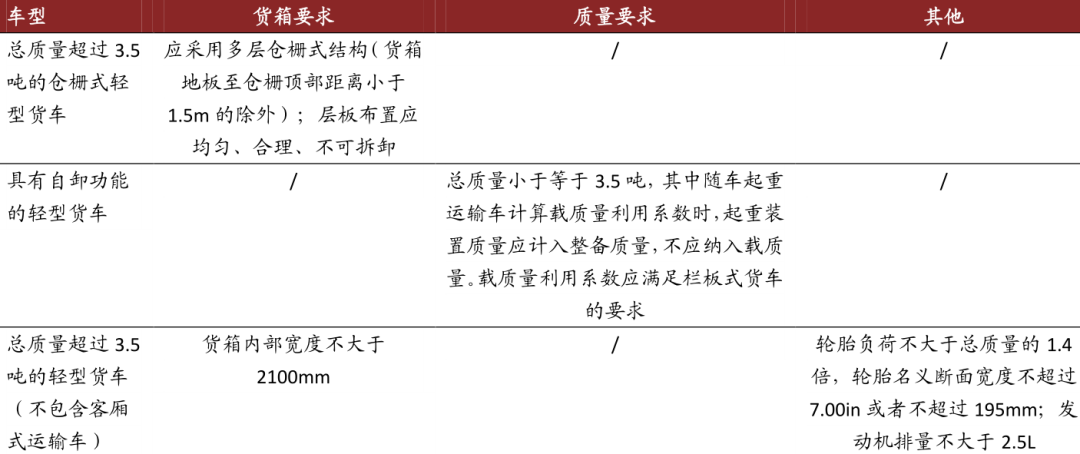

2021年新政将规范重卡技术参数,开展重卡“供给侧改革”,从源头上规范重卡生产。 近日,部分整车厂收到《大吨位小标准管理-技术要求附件》征求意见通知,进一步规范重卡箱体规格、总质量、承载能力等参数的参数要求。 不符合要求的重卡产品将难以获得资质。 证书。 以总质量超过3.5吨的重卡为例,《技术要求附件》要求重卡箱体内部长度不小于2100mm,底盘排量不小于2.5L货运汽车,轮胎总质量不小于1.4倍。 这一技术指标限制了重卡的超载能力,大大增加了蓝牌重卡在实际运营中变身“十吨王”的可能性。 我们认为,重卡参数要求的细化,从源头上控制了“大吨位、小规格”轻卡涌入市场,有利于实现重卡“供给侧改革”卡车。

图:《大吨位小标准管理-技术要求附件》征求意见稿对重卡产品行李箱、质量等提出了明确要求。

来源:转气家园、

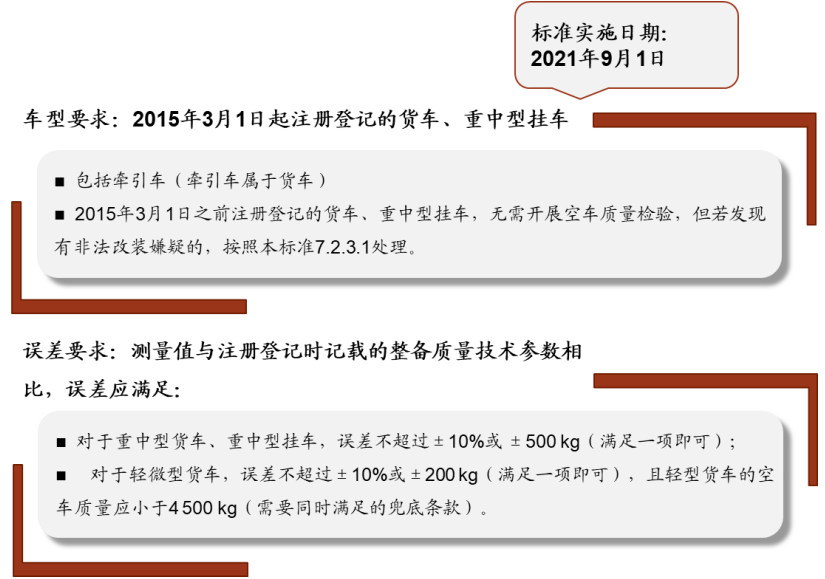

在新的车辆检查政策下,大吨位和小规格车辆有望快速通关。 2021年实施《机动车安全技术检验项目和技术(GB38900-2020)》。 与2014年版相比,新版车辆检验标准对在用机动车检验增加了新的空车质量要求,要求2015年3月1日起登记注册的乘用车应符合以下要求: 1)车辆检验时,中、轻型货车、货车空车质量偏差范围在10%或500公斤以内; 2)车辆检验时,轻型客车空车质量偏差范围在10%以内或200公斤以内,且空车重量不得超过4.5吨。

图:新车检政策对在用机动车提出要求

Source: "Motor Vehicle Safety Technical Inspection Items and Techniques (GB38900-2020)",

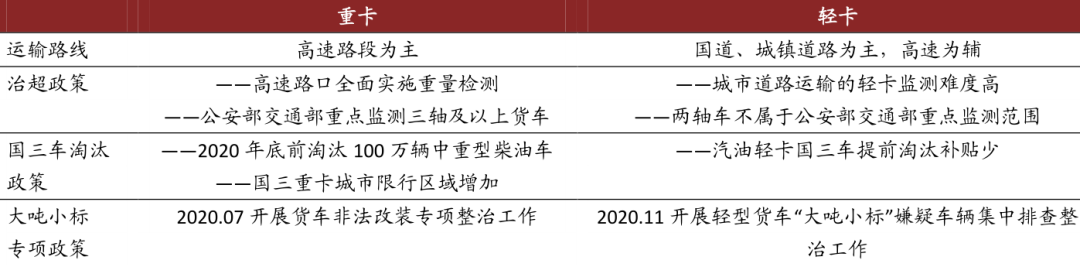

Comparative Summary of New Deals for Heavy Trucks vs. Light Trucks

Based on the above-mentioned review of the new industry policies for light trucks and heavy trucks, we found that since the Ministry of Public Security and the Ministry of Transportation implemented special work to control overruns and limits in 2016, there is a big difference in the regulatory intensity faced by light trucks and heavy trucks. On the one hand, the special work focuses on passenger cars with three axles and above, which means that two-axle heavy trucks are not included in the key inspection scope, and heavy trucks face even less enforcement of overtaking regulations. On the other hand, based on the differences in transportation routes between heavy trucks and light trucks, we found that light trucks whose main application scenarios are highway sections are more likely to undergo weight measurement at highway intersections, while heavy trucks that are mainly used for urban road transportation are more difficult to inspect. , there is a certain space for evading supervision. In addition, medium- and light-duty National III gasoline vehicles are a key model to be phased out by the country. Local governments have promulgated many new policies in terms of subsidies and restrictions, and their early phase-out will drive demand for light truck renewal. However, subsidies for the early phase-out of state-of-the-art heavy-duty trucks are relatively low, and there are relatively few restrictions on road rights, leaving consumers with insufficient motivation to change vehicles.

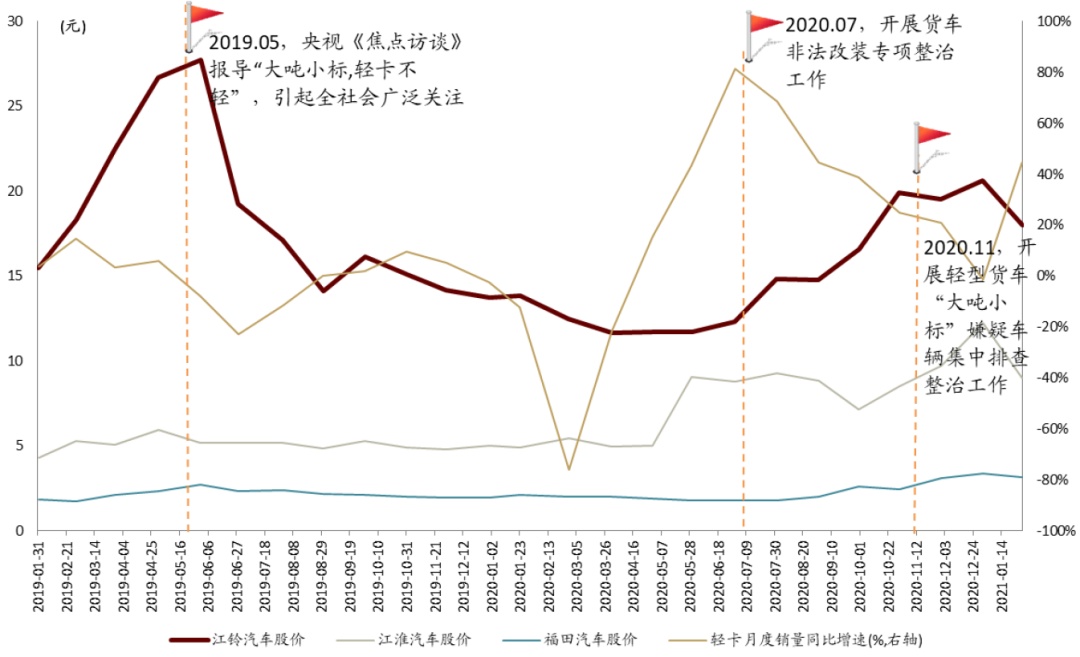

In 2020, the rectification of overcrowded trucks will be tightened, and the Ministry of Public Security will conduct centralized inspection and management work on large-ton, small-standard heavy-duty trucks. In May 2019, Satellite TV's "Focus Interview" program exposed the phenomenon of illegal production of "large tons and small standards". At the end of the year, the Ministry of Housing and Urban-Rural Development launched a special rectification work on "large tons and small standards". In July 2020, the Ministry of Housing and Urban-Rural Development, the Ministry of Public Security, the Ministry of Transport, and the State Administration for Market Regulation organized a special campaign to deal with illegal truck installations. They conducted a comprehensive investigation and management of bus production and installation companies, focusing on detecting whether there were any violations of national safety technologies. Standards and other issues, unqualified car companies will be suspended or withdrawn from the "Announcement" and punished in accordance with regulations. If a crime is committed, the person in charge of the company may be held civilly liable. In November 2020, the Ministry of Public Security held a centralized investigation of suspected "large-ton and small-standard" cars to conduct stricter supervision of existing and new cars.

Chart: Comparison of new policies for heavy trucks and heavy truck industry

Source: "Special Action Plan for Rectifying Illegal Overcrowding on Road Passenger Vehicles", "Notice on Holding Centralized Investigation and Management of Suspected Heavy Trucks with "Large Tonnage and Small Standards"",

Taking light trucks as a lesson and looking forward to the direction of heavy truck sales and profit elasticity

Review of light truck sales and stock prices of listed companies: New policies have significant effects

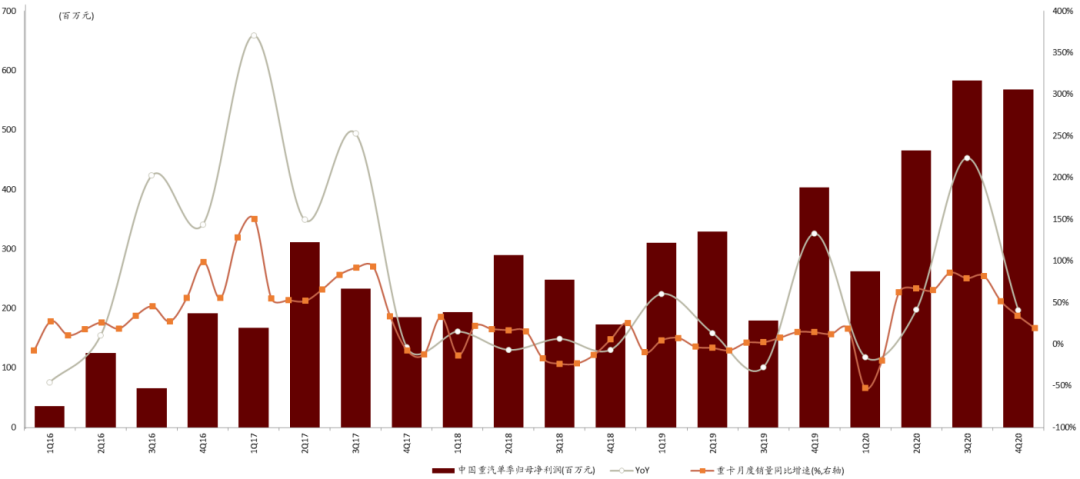

Based on the above analysis of the New Deal, we combined the monthly sales data of light trucks, the performance and stock price of China Shaanxi Automobile, the leading company in the heavy truck industry, to study the impact of the New Deal on sales and the company's stock price. From the perspective of the New Deal, light truck sales can be roughly divided into three stages:

1) 2016-2017 is the first stage. In August 2016, the Ministry of Transport and the Ministry of Public Security jointly issued the "Special Action Plan for Rectifying Illegal Overruns and Overcrowding on Road Passenger Vehicles", and carried out key tasks to control overruns and overloads from the central and local governments. Immediately afterwards, the road freight freight index rose rapidly, and the highest freight index fell by 25% from the high point during the year. The sales of light trucks increased rapidly under the influence of the super market control. From 2016 to 2017, the sales of light trucks reached 728,000 and 1.111 million respectively, with month-on-month growth of 32% and 53% respectively.

2) 2018-2019 is the second stage. In July 2018, the State Council issued the "Two-Year Action Plan to Win the Blue Sky Defense War". Since then, various regions have successively promulgated new subsidies to encourage the elimination of National III vehicles and new policies to restrict the operation of National III vehicles. Light truck sales have entered a stage of slow decline. From 2018 to 2019, light truck sales reached 1.148 million and 1.174 million units respectively, with month-on-month growth rates of 3% and 2% respectively.

3) The third phase begins in 2020. In March 2020, Zhejiang, Hunan, Jiangsu, Zhejiang and other provinces and cities will hold branch line super-control activities. In addition, 2020 is the last year of the "Two-Year Action Plan to Win the Blue Sky Defense War". Many places have limited the end of 2020 to the last year of National III vehicle replacement subsidies, accelerating the demand for renewal of existing light trucks. In 2020, light truck sales reached 1.616 million units, a month-on-month increase of 38%.

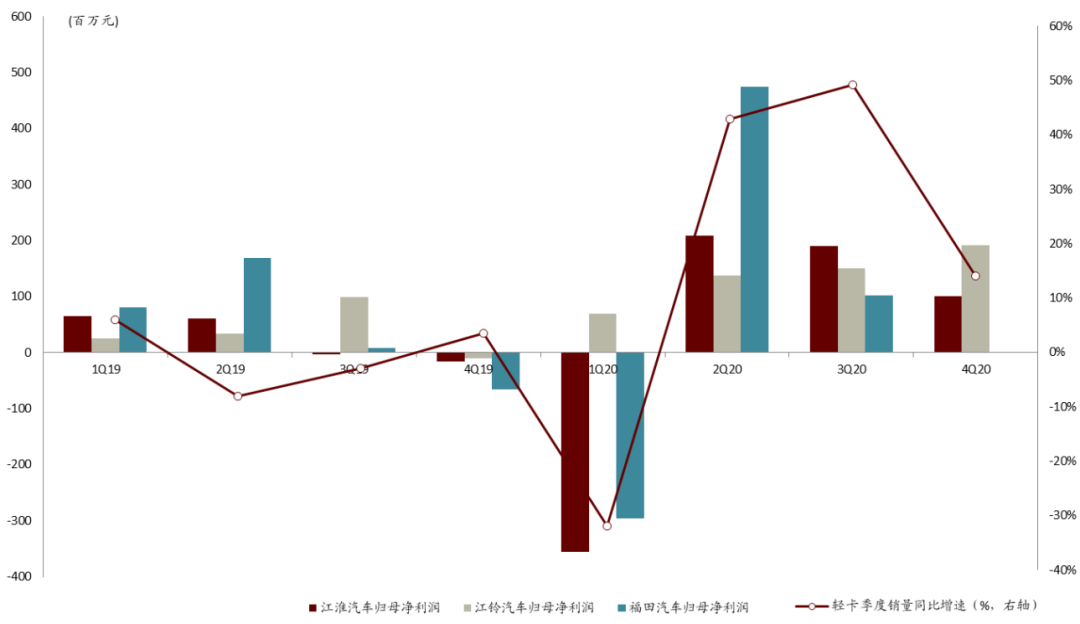

During the industry's upward cycle, the performance elasticity of leading companies is lower than the industry's sales elasticity. During 2016-2017, 2018-2019, and 2020, the average quarter-on-quarter sales growth of the light truck industry was 46%, 3%, and 41% respectively, while the average quarter-on-quarter growth of China Shaanxi Automobile's quarterly net income attributable to the parent company reached 135%, 23%, respectively. %, 73%. We believe that leading companies are better than the industry average in many aspects such as products, channels, services, etc., combined with the release of scale effects brought about by increased sales, the performance elasticity is lower than industry sales growth.

At the same time, we found that there is a significant correlation between the stock price of leading light truck companies and light truck sales. High month-on-month declines in light truck sales are generally accompanied by declines in the stock prices of leading truck-focused companies. Especially in the second half of 2016 and 2020, the corresponding maximum declines in the company's stock prices reached 78% and 161% respectively.

Chart: Review of light truck sales and leading company performance (2016-2021)

Source: Wind Information, China Automobile Association,

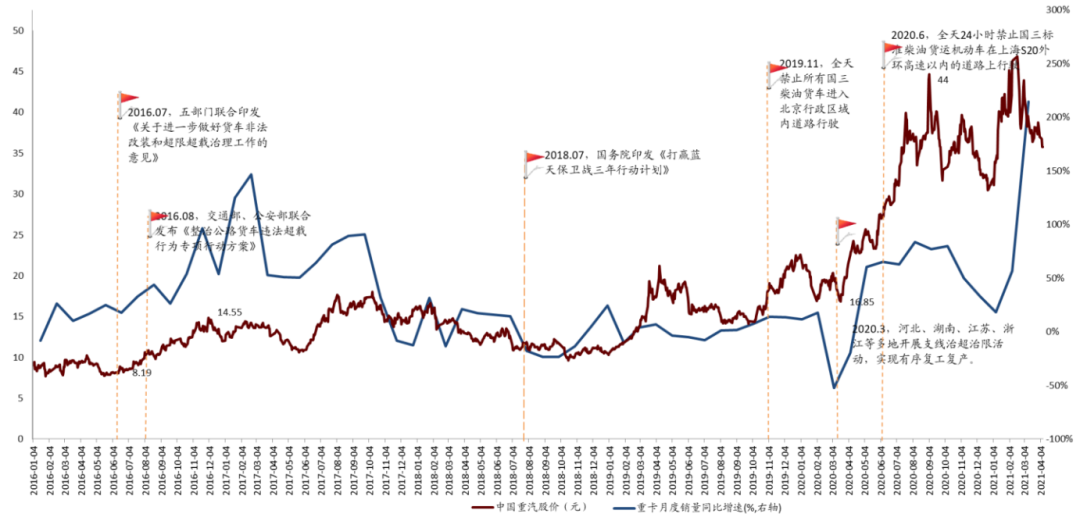

Chart: New Deal, Heavy Truck Sales, Stock Price Review (2016-2021)

Source: China Automobile Association,

Heavy-duty truck sales and stock price resumption of listed companies: the flexibility in the early stage is weaker than that of light trucks

From 2016 to 2020, the sales volume of the light truck industry dropped from 1.543 million units to 2.197 million units. During the period, the CAGR was 9.2%, and the sales growth was weaker than that of the light truck industry. Combining the application scenarios of heavy trucks and light trucks, we found that there are differences in the impact of the new policy on overcrowding. Light truck transportation is mainly on highway sections, so it is easier to detect overcrowding at highway entrances, while heavy truck transportation is mainly on provincial highways and urban highways. , supplemented by high speed, it is more difficult to supervise. In addition, the intensity of subsidy and restrictions on the phase-out of National III heavy-duty trucks in various regions are higher than that of heavy-duty trucks, and consumers are not motivated enough to eliminate National III vehicles early.

Chart: Sales volume of youth card industry from 2014 to 2020

Source: China Automobile Association,

Chart: Review of Heavy Truck Monthly Sales (2016-2021)

Source: China Automobile Association,

Reviewing the performance of heavy-duty trucks after the industry's "large-tonnage, small-standard" regulation in 2019, we found that the performance elasticity of leading heavy-duty truck companies has a low correlation with heavy-duty truck sales. The main reason is that including Foton Vehicles, Jiangling Vehicles, and JAC Vehicles Most of the leading heavy-duty truck companies in China have adopted the development strategy of "simultaneous development of business and passenger vehicles", which has caused the company's performance to be affected by the decline in passenger vehicle sales. Similarly, at the stock price level, the driving effect of heavy truck sales on the stock prices of leading companies is not significant. We believe that as leading companies refocus on the commercial vehicle business, revitalize existing assets, and increase production capacity utilization, the decline in sales volume in the heavy truck industry will bring greater flexibility to leading companies.

Chart: Heavy truck sales and performance review of leading companies (2019-2020)

Source: China Automobile Association,

Chart: Heavy truck sales and share price review of leading companies (2019-2020)

Source: CAAM,

Heavy-duty truck sales deduction: short-term replacement demand decreases, medium-year inventory center increases

In the short term, the new vehicle inspection policy promotes the standardization of vehicles in use, and the stock of "large ton and small standard" light trucks is quickly cleared, forming a demand for heavy truck replacement. The new policy for annual review in September 2021 lowered the inspection requirements for the quality of empty vehicles in use, requiring that the quality of empty vehicles deviate from the registered value by more than 10%. According to the motor vehicle management regulations, cargo vehicles shall be inspected once a year within 10 years, and once every 6 months for more than 10 years. For some large-ton and small-scale heavy trucks with no load or super-total quality, we expect to realize rapid clearance under the new vehicle inspection policy. We feel that in the short term, consumers will wait and see the implementation of policies, which may cause disturbances to monthly sales in 2021, showing a trend of highs and lows throughout the year.

From a mid- to long-term perspective, heavy-duty truck overload control will become more stringent, technical indicators for superimposed heavy-duty truck production links will be further clarified, and heavy-duty truck bicycle transport capacity will increase, leading to an increase in the number of heavy-duty trucks. The "Technical Requirements Annex" requires that the internal length of the heavy truck box should be no less than 2100mm, the chassis displacement should be no less than 2.5L, and the tires must be no less than 1.4 times the total mass. Over the years, this technical index limits the ability of heavy trucks to overcrowd, helps to standardize the quality of heavy trucks, and realizes the growth of bicycle transportation capacity. We use the number of youth cards in 2019 as the base to calculate the elasticity of the number. According to our calculation results, assuming that 20% of the heavy-duty trucks in stock are overcrowded, and bicycles are overcrowded by 3 tons, after these heavy-duty trucks are compliant, the bicycle transport capacity will increase, and the number of heavy-duty trucks will increase to 24.71 million. Compared with 2019 down 30%.

Chart: Calculation of Heavy Truck Holdings

来源:

文章来源

This article is excerpted from: "Revisiting the New Deal for Light Trucks, and Deducing the Logic of Increasing the Perennial Ownership of Heavy Trucks" published on April 14, 2021

Analyst Deng Xue SAC Practice Certificate Number: S0080521010008

Analyst Ren Danlin SAC Practice Certificate No.: S0080518060001SFCCERef: BNF068

Analyst Chen Zhenhao SAC practice certificate number: S0080520050001SFCCERef: BPR665

Scan the QR code and open an account in 3 minutes>>

海量资讯,精准分析,尽在新浪财经APP